COLLATERAL ASSESSMENT REVIEW

Accelerate Underwriting: RPS Rule Engines Minimize Your Risk

What is the RPS Collateral Assessment Review (CAR)?

The RPS Collateral Assessment Review (CAR) is a fully automated and comprehensive collateral assessment solution for mortgage lenders, servicers, and insurers. RPS applies powerful rule engines to assess the underlying collateral used to secure a mortgage, based on the appraisal report, to highlight those where the underlying collateral may pose a risk. Each CAR report generated provides a summary review of the collateral and details about any potential collateral risks, enabling you to make better, more informed decisions.

A Proven Underwriting Tool

- Most comprehensive and flexible solution in the industry

- Increased accuracy for better risk management

- Objective, consistent, and fast to deliver efficiency

- Improve end-customer experience and staff satisfaction

Key Benefits

Real Efficiencies

Reduces the need for your team to read every appraisal report in detail to find potential collateral risks by identifying files where possible collateral risks require review.

Better Decisions

Delivers meaningful information to your review teams to enable better and more informed decisions about possible collateral risk to help prevent losses.

Reduce Risk

Leverage objective, comprehensive information to better support consistent internal collateral risk due diligence processes across all files.

Empower Staff

Empower staff and executives with information for better supported and more informed discussions with consumers, regulators and other internal stakeholders.

Over 350 Risk Rules Including

- Property is a rooming house

- Property has a commercial component, percentage used for commercial activities

- Property has structural damage, evidence of leaks

- Mobile home, modular home or mini home

- Property has a hotel component

- Present use does not conform to zoning

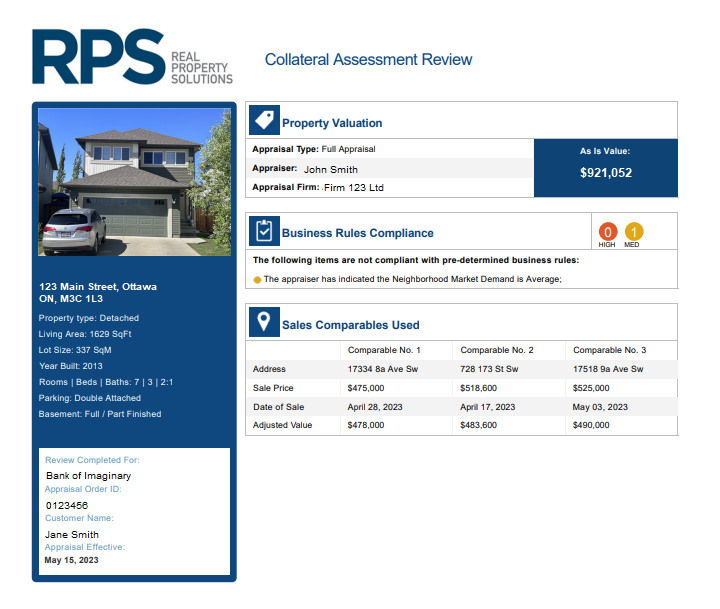

The CAR Report

The one-page RPS CAR report summarizes for your reviewers:

- Quick rule results section based on RPS standard rules, or your custom ruleset with policy-driven rule weightings

- Key appraisal and order details such as your customer reference number and name as well as the property’s address, lot size and appraised value

- Ranked by importance, the list of rules triggered provides details on the issues to potentially be resolved

Contact Us

Don’t hesitate. We’re here to help.

Want to unlock opportunities with RPS? Fill out the form and one of our Appraiser Success team members will be in touch.

1-877-658-8258

39 Wynford Drive, Toronto ON, M3C 3K5

By submitting this form, you are consenting to receive emails from RPS Real Solutions Inc. You can change your consent at any time by using the SafeUnsubscribe® link found at the bottom of every email.